Chamwe Kaira

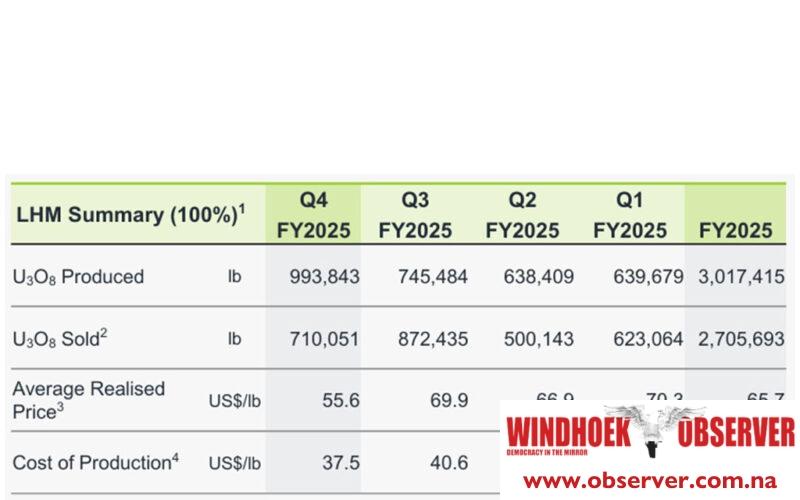

Paladin Energy says its Langer Heinrich Mine produced 993,843 pounds of uranium oxide during the quarter ending 30 June, a 33% increase from the previous quarter.

This marks the highest quarterly output since the mine restarted operations, bringing total production for the financial year to 3 million pounds.

During the same quarter, the mine sold 710,051 pounds of uranium oxide, with total sales for the year reaching 2,705,693 pounds.

Paladin also signed one new uranium sales agreement in the quarter, bringing its total to 13 agreements with tier-one customers in the US, Europe, and Asia.

The company achieved an average realised price of US$55.6 per pound for the quarter. It noted the lower price was due to the mix and timing of contract deliveries.

“Quarterly sales and average realised prices depend on the mix of contract pricing mechanisms, payment terms and the timing of individual deliveries based on customer requirements from quarter to quarter,” the company said.

The average realised price for the full financial year was US$65.7 per pound. This figure reflects a balanced portfolio made up of base-escalated, fixed-price, and market-related contracts.

Paladin said its mine plan prioritises medium- and high-grade ore delivery to the processing plant, while low-grade ore is being stockpiled for future use. Costs related to the stockpiled ore will be disclosed separately in future reports.

As of 30 June 2025, Paladin held US$89 million in cash and cash equivalents, excluding restricted cash of US$4.4 million.

The total unrestricted cash and short-term investments fell by US$38.8 million from the previous quarter.

The decrease was attributed to the start of mining operations and timing-related working capital movements, including revenue recognised in the quarter but only received in July, when the company collected US$29.2 million.

Paladin noted that sales volumes, revenue, and cash flows may vary each quarter due to shipping and customer delivery schedules.

These quarterly results do not necessarily represent annual performance.

The company made its second scheduled debt repayment of US$6.7 million during the quarter, leaving a closing debt balance of US$86.5 million.

Paladin also maintains an undrawn revolving facility of US$50 million.