Chamwe Kaira

The Bank of Namibia (BoN) will conduct a bond auction on Wednesday to raise N$2 billion. The issuance includes N$1.5 billion in nominal fixed-rate bonds and N$500 million in inflation-linked instruments.

This comes after BoN announced that an additional N$2 billion will be raised through the domestic market because of delays in external sourcing. Overall banking industry liquidity currently stands at N$7.4 billion, with the Namibian position at N$1.67 billion.

Kara van den Heever of Simonis Storm Securities said the previous bond auction drew strong interest, with bids of nearly N$1.7 billion against an initial offer of N$487 million. In the Internal Registered Stock segment, N$1.38 billion was tendered against an allocation of N$407 million. Bids were especially strong for the GC35, which attracted N$240 million, though only N$40 million was allocated.

The GC28 bond saw its highest yield accepted drop by 51 basis points to 8.29%, while GC32 fell by 47 basis points to 9.38%. Yields on longer-dated bonds such as GC48 and GC50 also declined by 44 basis points. Inflation-linked bonds also recorded healthy demand, with N$330.6 million tendered against an initial offer of N$80 million. The newly issued GI41 was the most sought-after instrument.

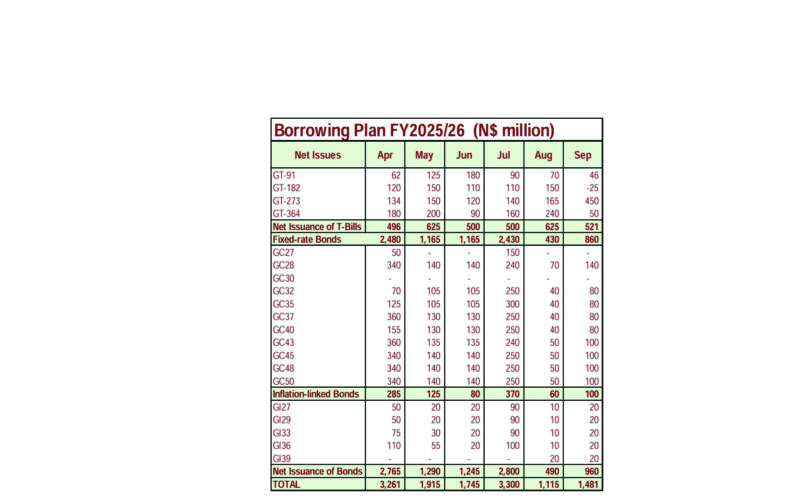

BoN and the ministry of finance project a fiscal deficit of N$12.8 billion for the 2025/26 financial year, equal to 4.6% of GDP. With foreign loan repayments of N$3.8 billion, local bond redemptions of N$3.9 billion, the outstanding Eurobond, and other financing needs, the total financing requirement is N$29.8 billion.

Of this, N$21.2 billion is expected to be sourced locally and N$8.6 billion externally. Domestic borrowing will include N$6.4 billion in treasury bills, N$13.2 billion in fixed-rate bonds, and N$1.7 billion in inflation-linked bonds.

Compared to the N$15 billion domestic borrowing requirement in 2024/25, the current year reflects an increase due to a higher level of maturing debt.

The central bank and the ministry of finance said borrowing has been frontloaded in the first half of the year to match the repayment profile, take advantage of strong liquidity, and build buffers ahead of large redemptions due in the same period.

Caption

The Bank of Namibia will conduct a bond auction to raise N$2 billion.