Chamwe Kaira

The Bank of Namibia (BoN) has launched a gold accumulation strategy to diversify the country’s foreign exchange reserves and strengthen economic stability amid global uncertainty.

BoN governor Johannes !Gawaxab said the strategy is part of a broader effort to protect Namibia’s financial system and improve its resilience against external shocks.

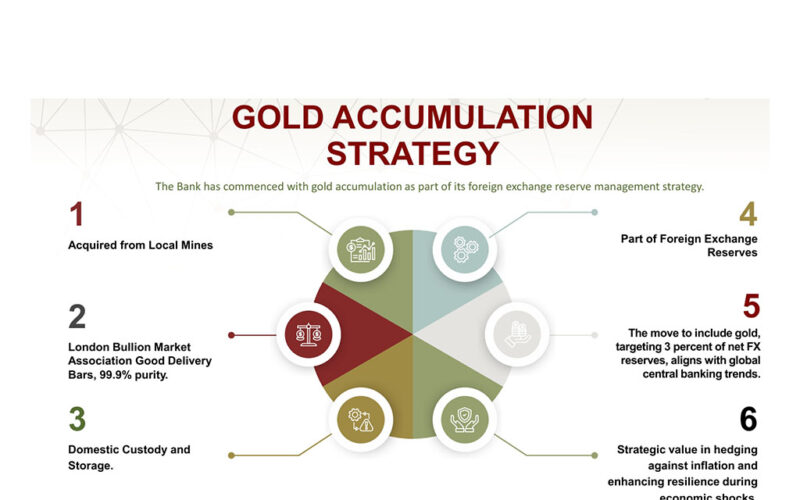

He said gold will now form a key component of the central bank’s reserves portfolio, targeting 3% of total net foreign exchange holdings.

The gold will be acquired from local mines, kept under domestic custody and stored as London Bullion Market Association (LBMA) good delivery bars with 99.9% purity.

“Gold remains a strategic asset, a store of value, an inflation hedge, and a symbol of sovereign autonomy,” !Gawaxab said.

The move aligns Namibia with a growing number of central banks turning to gold amid dedollarization, geopolitical tensions, and persistent inflation.

Global gold prices have reached record highs as investors seek safe-haven assets.

The gold strategy comes as the global economy faces slower growth.

The bank projects global output to ease to 3.2% in 2025 from 3.3% in 2024, with advanced economies expected to grow by only 1.6%.

Domestically, Namibia’s gross domestic product (GDP) growth is expected to slow to 3.5% in 2025 before slightly improving to 3.9% in 2026.

Inflation is projected to stay manageable, though the current account deficit will remain high.

As of 30 September, Namibia’s foreign reserves stood at N$54.7 billion and are expected to close the year at N$47.2 billion after the redemption of the US$750 million Eurobond on 29 October 2025, repayments to the International Monetary Fund (IMF) and commercial bank outflows.

The bank plans to replenish reserves through foreign loans and stable Southern African Customs Union (SACU) receipts.

Despite these pressures, !Gawaxab said preparations for the Eurobond repayment are on track, with N$13.5 billion mobilised.

He said this reflects Namibia’s commitment to investor confidence and prudent debt management.

The bank also reported that the domestic financial system remains stable and well-capitalised, with strong oversight by both banks and non-bank financial institutions.

Meanwhile, the diamond industry continues to struggle as global prices drop due to weaker demand in major markets, growing competition from lab-grown diamonds, and high inventories.

Namibia’s diamond output is forecast to contract by 4.5% in 2025, while export earnings have already declined by nearly 20% this year.

Despite these challenges, !Gawaxab said the Bank’s gold strategy and disciplined management of reserves will help safeguard Namibia’s financial stability.