Tujoromajo Kasuto

Last week, Bank of Namibia Governor Johannes !Gawaxab met with his counterparts on the continent as part of his efforts to strengthen collaboration and seek mutually beneficial relationships among African central banks.

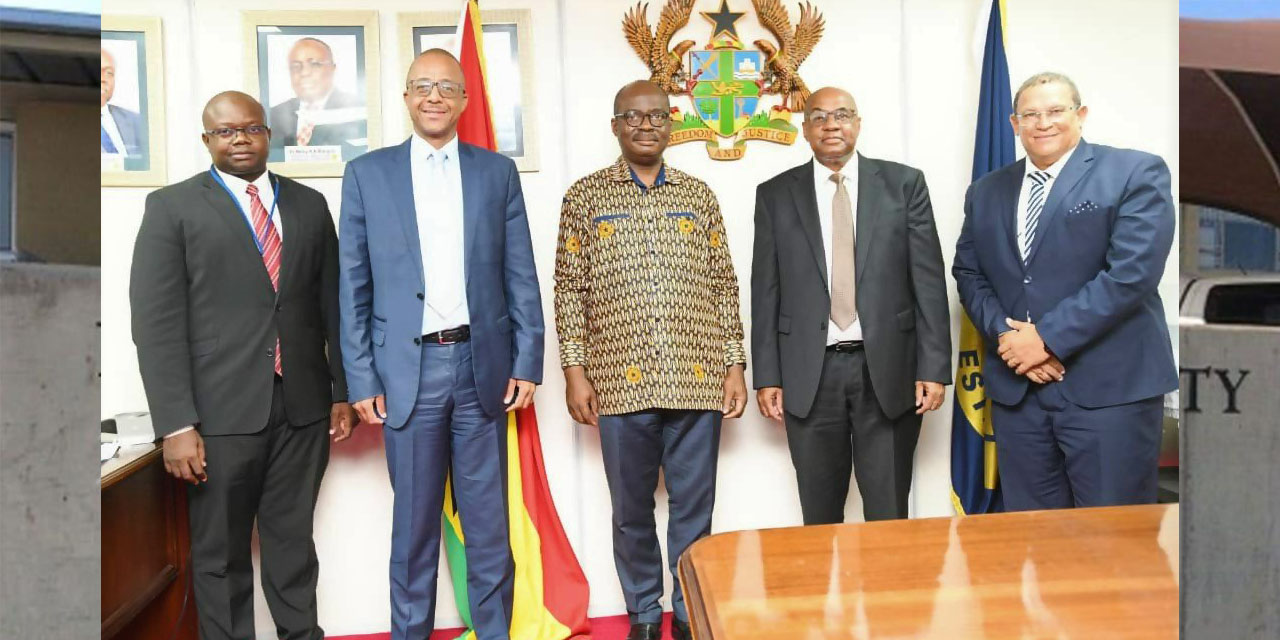

According to the Central Bank’s Director of Strategic Communications and International Relations, Kazembire Zemburuka, separate meetings were held to strengthen ties between the Governors of the Bank of Ghana, Ernest Addison, and the Bank of Botswana, Moses Dinekere Pelaelo.

He says that the Bank also intends to call on the Central Bank of Kenya, given the advances made in the fintech space.

Zemburuka noted that the courtesy visits extended collaboration efforts while discussing key price and financial stability issues and economic developments such as inflationary challenges in African economies because of the Russia-Ukraine conflict, potential recession in advanced economies, and supply chain disruptions, and the responses to date based on each country’s peculiar circumstances.

Furthermore, issues of rising debt levels featured prominently as well as efforts to tackle the challenge.

‘’The discussions also aimed to compare notes on the digital transformation of respective institutions, digital currencies, fintech, and financial inclusion, among other emerging central banking topics. While pursuing collaboration on relevant projects to aid cooperation on these and other topics, the importance of learning from one another through benchmarking was emphasised,’’ he said.

In Ghana, !Gawaxab emphasised the significance of formalising cooperation with the Bank of Ghana in the spirit of the two countries’ excellent relations. !Gawaxab indicated that the Bank had launched its Strategic Plan (2022-2024), which outlines its transformational journey aimed at digitising the Bank and enhancing financial inclusion to serve the excluded.

He further signified challenges experienced in the informal economy and Namibians’ inability to access affordable and quality services primarily in rural areas.

Zemburuka furthermore stated that the Bank has done significant research on how financial inclusion in the informal economy and rural parts of Namibia can be further enhanced and wanted to compare notes given progress in this space in Ghana.

Meanwhile, Governor !Gawaxab remarked that they have observed that the Bank of Ghana is wrestling with these issues, and commended that they have not sat back and let the market sort itself out.

‘’You have innovated by providing practical solutions such as Ghana Pay which was recently

Launched as a mobile money service. Furthermore, your courageous move to explore CBDCs as a critical intervention to balance the interests of all economic agents is something worth learning from,’’ said !Gawaxab.

Additionally, Bank of Ghana’s Addison recognised their own initiatives established and implemented, such as banking sector reforms, mobile money interoperability, and CBDCs, in response to some of these developments.

Consequently, the two central banks will sign a Memorandum of Understanding on mutually agreed-upon topics to formalize the cooperation.

!Gawaxab also extended a visit to his Botswana counterpart, Governor Moses Dinekere Pelaelo, and his team. The Bank of Botswana also presented on operations of the central bank and shared relevant information on the Pula Fund – Botswana’s highly impactful sovereign wealth fund.

Governor !Gawaxab narrated Namibia’s own experience with the launch of the Welwitschia Fund and noted that the two countries could learn a great deal from one another in furtherance of their respective mandates and the shared prosperity of their people. The visit resulted in the two institutions cooperation being renewed.