Ester Mbathera

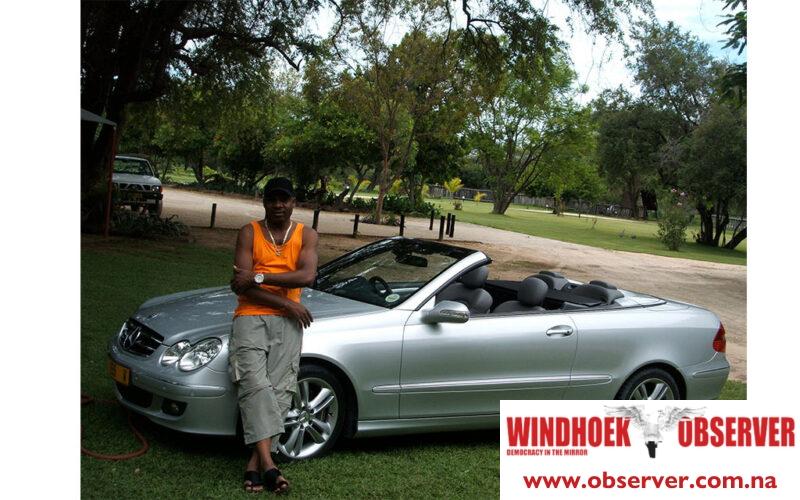

The businessman Daniel Kamunoko, who is suing Standard Bank Namibia for about N$184 billion has been driving two vehicles that were reported stolen by the bank in 2009.

The vehicles involved are an AMG C55 and a CLK cabriolet Mercedes Benz which are still in Kamunoko’s possession.

In court documents, Kamunoko claims that he wanted to sell the AMG but the vehicle failed to get police clearance.

“It was when I discovered that both vehicles were reported stolen on 16 April 2009. In other words, I have been driving these Benzes for ten years, stolen by myself as reported by Standard Bank,” he said.

In a police statement, the credit controller of the bank, Joseph Loxton stated that he reported the theft of the two vehicles on 10 December 2009.

The statement is part of the evidence in the court documents.

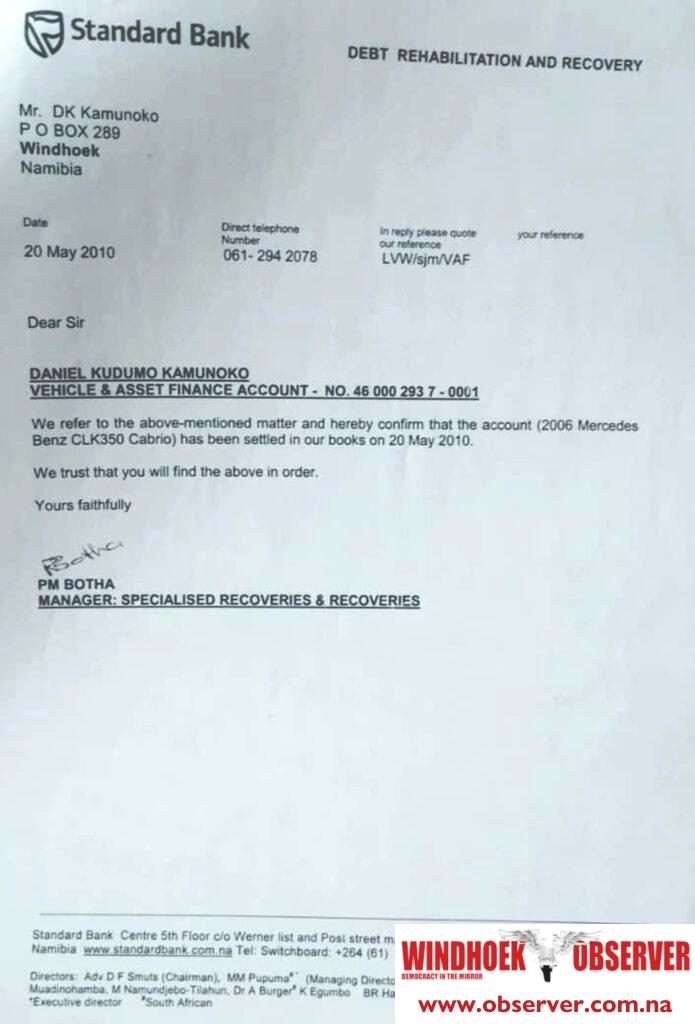

In the statement, Loxton confirmed that the vehicles were shown to him on 20 May 2010.

At the time when he reported the vehicles stolen, Loxton claimed that Kamunoko failed to pay the instalments of the vehicles which he bought in May 2005 and June 2006 respectively.

“The last payment for the AMG was October 2008. On the Mercedes Benz CLK 350, the last payment was in October 2007. He gave the vehicles to Miss Kasiku to look after his property. The two vehicles are still in her possession as Mr Kamunoko is out of the country and she failed to pay the outstanding balance,” said Loxton.

He claimed to have attempted to contact Kasiku who was nowhere to be found.

At the time the outstanding amount was N$100,000.

Loxton said he wanted to collect the vehicles because they were still the property of the bank.

On 21 May 2010, he requested the police to not take any further criminal action in the matter and withdrew the case.

“The suspect paid the bill in full and there is no further interest in the case,” Loxton gave as a reason to withdraw the case.

The settlement was also confirmed in letters from the bank’s debt rehabilitation and recoveries that were sent via postal mail to Kamunoko on 20 April 2010 and as part of evidence provided to the court.

“We refer to the above-mentioned matter and hereby confirm that the account has been settled in our books on 12 May 2010. A notification will be sent to ITC to update their books,” reads the letter from the debts rehabilitation and recovery department.

The theft of the vehicles was reported while Kamunno was imprisoned in Hong Kong in 2008.

His incarceration caused his accounts with the bank to fall into arrears.

This led to him defaulting on his overdraft and other credit facilities, including the two vehicles.

When he was released from prison and returned to Namibia in 2009, Kamunoko said he paid N$2 million into his personal bank account to settle his debt with the bank.

He expected the money to cover expenses related to properties and vehicles.

The N$2 million payment into his account is currently a bone of contention between Kamunoko and the Bank.

In the court documents, Kamunoko is demanding that the bank provide evidence of what happened to the N$2 million and how it was allocated.

Kamunoko asserts that instead, the bank is demanding that he provide proof of deposit, as the money cannot be traced.

Apart from having paid for the vehicles with cash, Kamunoko further claimed that the bank fraudulently claimed the vehicles from an insurance policy created in his name which he said he was not aware of.

“Standard Bank reported my vehicles as stolen to the police CR718/04/09 to claim my insurance. I insured my belongings including the two Mercedes Benzes on this insurance policy number NAP0019886, the original insurance policy with Hollard Insurance but Standard Bank is the insurance broker and they changed my insurance policy number to NAP0031473 and claimed by insurance,” he claimed in court documents.

Documents seen by the Windhoek Observer show the two policies covering the same items.

Standard Bank spokesperson Magreth Mengo did not respond to questions sent to her via email on 8 April.

The Windhoek Observer wanted to know how the payment for the vehicles was settled.

Whether he paid for the vehicles or the bank claimed them from an insurance policy as Kamunoko claimed.