24

Oct

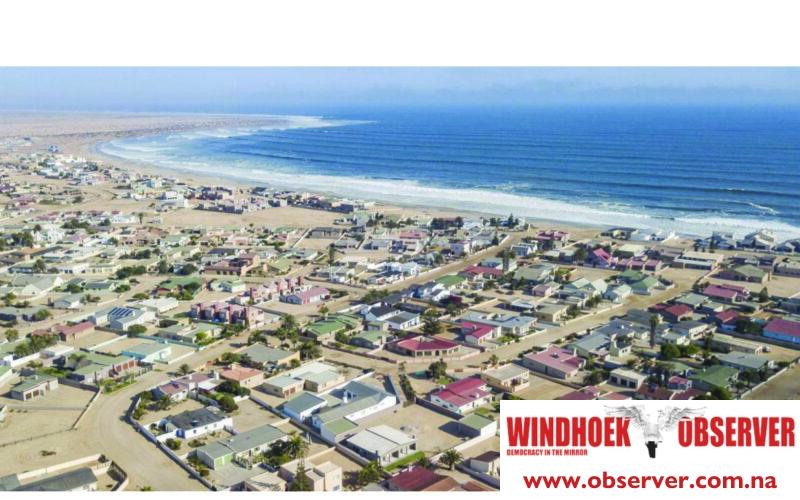

By Allexer Namundjembo President Netumbo Nandi-Ndaitwah has reaffirmed her administration’s ambitious goal of creating 500,000 jobs within five years, despite the government’s ongoing freeze on public service vacancies, a policy that continues to draw sharp criticism from the public and political commentators. Speaking at the inaugural Namibia Public-Private Forum in Windhoek on Thursday, the President said her government was determined to drive “a new era of decisive, efficient, and results-driven governance” focused on economic growth, inclusivity, and employment. The job creation pledge is anchored in the recently launched Sixth National Development Plan (NDP6), themed “Fostering Economic Growth, Inclusiveness, and Resilience…