15

Aug

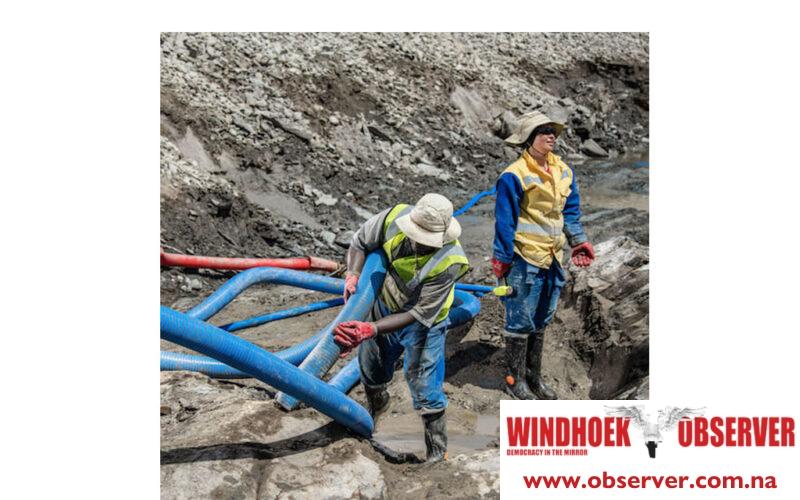

CHAMWE KAIRA The Otjikoto Mine continued to outperform during the second quarter of 2024, producing 48 143 ounces of gold, above expectations as a result of higher than anticipated mill feed grade, B2Gold Corporation said. For the second quarter of 2024, mill feed grade was 1.79 grams per tonne (g/t), mill throughput was 0.85 million tonnes, and gold recovery averaged 98.6%. B2Gold said ore production from the Wolfshag underground mine for the second quarter of 2024 averaged over 1500 tonnes per day at an average grade of 4.69 g/t gold. As of the beginning of 2024, the probable mineral reserve…