14

Dec

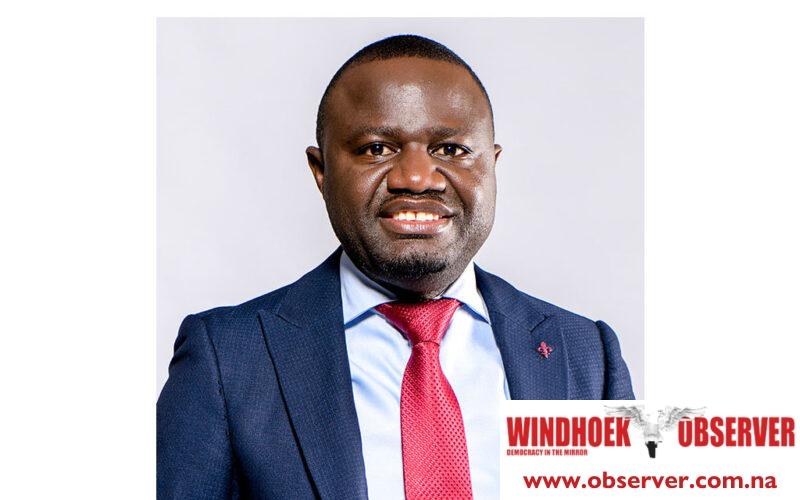

Martin Endjala According to Jan Coetzee, Managing Director of Headway Consulting, Namibia is making significant strides in embracing technology, establishing best practices within organizations, and recognizing the advantages of adhering to international standards in enhancing service delivery and the bottom line. However, the country still faces certain challenges, and both organizations and the nation as a whole must take the need for streamlining processes, compliance, and digitalization more seriously. "Organizations can greatly benefit from Enterprise Resource Planning (ERP) tools and available software to facilitate this transformation," Coetzee said. He believes that by embracing and implementing such tools throughout an entire…