Moses Magadza and Clare Musonda

The SADC Model Law on Public Financial Management (PFM) that the SADC Parliamentary Forum is developing has attracted more praise, with some people commending it for touching, albeit in passing, on cryptocurrencies while others have called for more guidance on the phenomenon.

A cryptocurrency is a digital currency that works as a medium of exchange through a computer network. Media reports say that last year, money laundering through cryptocurrencies increased by 30 percent and involved about US$8,6 billion. Cryptocurrencies constitute a rapidly developing phenomenon that is being aggressively marketed, especially on social media platforms. Some people, including pensioners, have been lured into them by promises of often elusive quick returns, only to lose out.

With the crypto sector being largely unregulated and not much in place by way of official policy across many countries, some observers are calling on the evolving SADC Model Law on PFM to inform regulation, as some SADC Member States scramble to tame the cryptocurrencies jungle.

One observer, speaking on condition of anonymity, said: “There is a growing attraction to jump into the cryptocurrencies forest and everyone has taken their bow and arrow to forage into that forest. There is very little protection via information on how things work. There is a lot that is opaque that needs to be unpacked and spelt out.”

For some people, cryptocurrency is a generational phenomenon. Citizens who are not tech-savvy or not comfortable using Information Communication Technology (ICTs) are reportedly having a hard time wrapping their heads around it or online trading.

The technological evolution and revolution taking place globally are ushering in changes in the way things are done, putting some people at the risk of being left behind. The big question is: is cryptocurrency worthy of taking note now, even in the development of regional legislation?

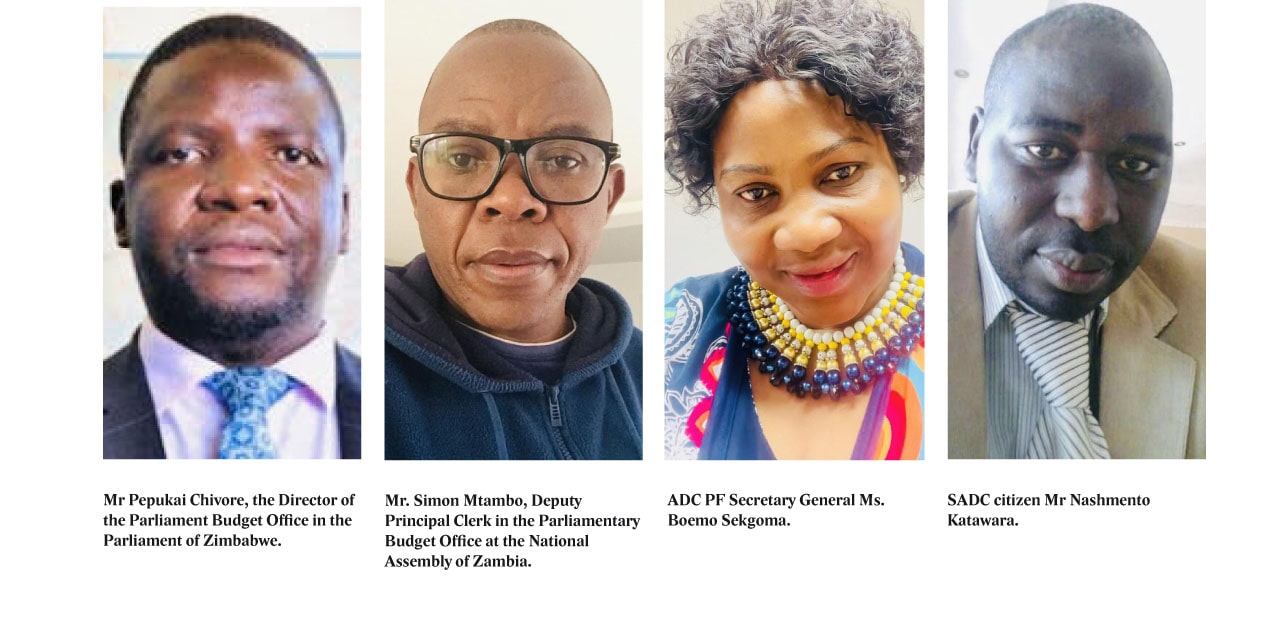

The answer, for Mr Pepukai Chivore, the Director of the Parliament Budget Office in the Parliament of Zimbabwe, is a resounding yes.

“Interestingly, Africa has fertile ground for the growth of cryptocurrencies. This ranges from under-developed infrastructure which makes it a strong vector for cryptocurrencies and growing mobile money applications. Money laundering via cryptocurrencies has grown and as such, some countries like Kenya have banned it,” he said.

He added, however: “While some may not support its use because of the lack of control and illicit ties, some countries have introduced regulations under their countries’ anti-money laundering and counter-financing of terrorism laws (AML/CFT) to reduce its use for these purposes.”

In November 2021 the Library of Congress (LOC) identified 103 countries whose governments had directed their financial regulatory agencies to develop regulations and priorities for financial institutions regarding cryptocurrencies and their use in AML/CFT. Only 42 countries had implicit bans on certain cryptocurrency uses as of November 2021.

Said Chivore: “It is, therefore, my well-considered opinion that whether we like it or not, we seem to be moving the cryptocurrency way and it’s better to be prepared. The Model Law on PFM will simply prepare Member States and serves as a benchmark and guiding legal instrument for National Parliaments to reinforce their domestic legal frameworks on PFM. Sovereign countries are free to disregard provisions on cryptocurrencies if they think they’re not necessary.”

He noted that cryptocurrency adoption in Africa grew 1200% between July 2020 and June 2021, making it the fastest adoption rate in the world. Markets like Kenya, Nigeria, South Africa, and Tanzania had some of the highest grass-roots adoptions in the world and ranked in the top 20 Global Crypto Adoption Index.

“SADC cannot brush aside such reports, but has to be ready, at least by having some guidance on regulation of cryptocurrencies in the event that some countries adopt them,” Chivore, a member of a Technical Working Group (TWG) helping veteran legal drafter Mr. Daniel Greenberg, CC, craft the regional soft law, said.

Zimbabwean citizen Mr Nashmento Katawara has been keenly following the development of the SADC Model Law on PFM. He noted that cryptocurrencies have been adopted in many parts of the world and some people have made money from them on the blockchain technology.

“I am so excited and impressed to hear that the SADC PF has included this in its evolving Model Law on PFM,” Katawara said.

He, however, said that rather than merely scratch the surface, the Model Law must have a rich section on cryptocurrency because that is where the world is going.

“In fact, we are already in that age. However, there is information asymmetry, with far too many people still clueless as to what cryptocurrencies are and how they are traded online,” he observed. He saluted the SADC PF for “pre-empting” the advent of cryptocurrencies and for championing regulation in that area.

“We certainly need regulation in this area because it involves the movement of lots of money. Any financial system needs regulation. This pre-emptive approach by SADC PF is commendable,” Katawara added.

He called for education on cryptocurrencies much earlier in life.

“Let us teach children about cryptocurrencies early, just like were are doing with Comprehensive Sexuality Education (CSE). Some of us didn’t learn about cryptocurrencies in school and yet they are now upon us.”

Mr. Simon Mtambo, Deputy Principal Clerk in the Parliamentary Budget Office at the National Assembly of Zambia and a member of the SADC Model Law on PFM TWG, concedes that cryptos are highly volatile because they tend to be speculative currency. That makes it difficult for central banks to regulate and license market players in the sector due to the complex nature of due diligence and certainty of value which can be deceptive. Additionally, Mtambo said the developed world was battling fraud and money laundering which fuels extortion, hacking and funding of subversive acts like terrorism.

“However, whether we like it or not and despite the negative publicity mainly from traditional monetary systems, cryptos are here to stay. It is time to start accepting that currency should not be paper-based only. The Model Law is trying to be flexible by recognizing other forms of currency including cryptos,” he noted.

Mtambo said embracing cryptocurrencies would not happen overnight as some members would be cautious while others may not accept them.

“As more and more engage in crypto, countries will have no option but to adjust their domestic laws because they will need to transact anyway. The beauty is that the SADC Model Law on PFM is already forward looking in this regard,” he reasoned.

Dr John Ernest Odada, Professor of Economics and Dean of the Faculty of Management Sciences at Rongo University in Kenya, said the adoption of cryptocurrencies would depend on how they instil confidence among traders.

“When something exists in a good way which trade partners are happy with; it can be used. Some of these currencies have led to people losing their money in online investments. Consequently, some countries are not happy with such currencies,” Odada, who spent nearly 20 years lecturing at universities within the SADC Region said.

While praising SADC PF for prompting debate on cryptocurrencies, Odada felt they could only become a medium of exchange when they command the confidence of trade partners.

“Without that confidence, they can’t be international mediums of exchange. We may need to wait and see in which direction these currencies develop,” Odada opined.

Many stakeholders are critically examining the draft SADC Model Law on PFM in a series of meetings the SADC PF has been convening. Some have generally welcomed it, saying that coming up with better fiscal management or better PFM is good, particularly in the face of crises the world is experiencing, such as the Covid-19 pandemic and natural disasters.

There is consensus that the crises afflicting the SADC Region and beyond require that countries manage their resources well and have good PFM models that can lead to better fiscal discipline to be strong when hit by different catastrophes or trade with the rest of the world within the context of the African Continental Free Trade Area.

Cryptocurrencies featured prominently in a consultation meeting convened by SADC PF for police representatives involved in investigating financial crimes and related offenses this week. Mr. Fadhili Mdemu from Tanzania Police Force said there was a fine line between cryptocurrency and pyramid schemes which have ruined many people’s lives. He called for a lot of investment in educating the public before cryptos could be accepted.

A delegate from Botswana concurred and said the capacity of law enforcement agents dealing with crimes and offences related to cryptocurrency should also be built. Greenberg said the SADC Model Law of PFM represented a fusion of approaches from a variety of jurisdictions including SADC Member States but implementation would consider local contexts.

On her part, SADC PF Secretary General Ms Boemo Sekgoma stressed that the SADC Model Law on PFM sought to build the capacity of the region’s National Parliament on prudent PFM in line with the Forum’s vision to be the flagbearer of democratization and sustainable development in close consultation with SADC policy organs.

– Moses Magadza is a communications and media specialist reading towards a PhD in Media Studies at the University of Namibia while Clare Musonda, a Lawyer and Social Scientist, is Director of Corporate Governance at SADC PF.