Staff Writer

Construction activity remained modest in Windhoek and Swakopmund during August, reflecting uneven momentum in both regions, according to Macro Pulse, an analyst at Simonis Storm Securities.

Windhoek recorded a slowdown in approvals, dropping from 261 in July, the highest monthly figure this year, to 176 in August. Swakopmund saw a similar trend, with approvals declining from 99 to 81 over the same period.

From January to August, Windhoek averaged 171 approvals per month, while Swakopmund averaged 68, underscoring Windhoek’s role as the country’s primary growth hub.

“However, Swakopmund’s gradual improvement compared to historical averages signals that the coastal town is emerging as a secondary growth pole, supported by its appeal for residential, commercial, and tourism-linked projects,” Pulse said.

Year-to-date, Windhoek received 1 575 building plan submissions, slightly lower than the 1 613 recorded over the same period in 2024. In August, submissions totalled 188, down from 221 in July.

Swakopmund recorded 545 submissions for the year to date, up from 353 during January to August 2024, highlighting growing investor interest in the coastal town.

In Windhoek, the value of approvals increased by 21% month-on-month, reaching N$215 million in August from N$178 million in July.

“Although approvals slowed in number, the higher project values point to a shift toward larger-scale developments. Cumulatively, approvals in 2025 have reached N$2.1 billion year-to-date, nearly double the N$1.2 billion recorded in the same period of 2024. This indicates that, despite recent moderation, strong investment commitments were already secured earlier in the year, particularly in commercial and mixed-use projects,” said Pulse.

In Swakopmund, the total value of approvals declined to N$95 million in August, down 18% from N$100 million in July. The year-to-date total stands at N$496 million, above the N$404 million recorded in the same period of 2024.

Pulse noted that last year’s figure was inflated by a few large one-off projects.

“The 2025 trend suggests a more normalised development pipeline, with activity spread across smaller-scale residential and commercial projects.”

Windhoek concentrated most of its activity on additions and alterations to existing structures, with 113 projects valued at N$50 million.

“This underscores a shift in focus toward property upgrades and extensions rather than new developments. Alongside these, 42 new houses, 14 boundary walls, and seven commercial buildings were completed. The composition highlights demand for residential improvements and smaller-scale projects, reflecting a cautious investment climate. Property owners appear more inclined to enhance existing assets while awaiting greater economic certainty,” said Pulse.

Expectations of lower borrowing costs from a possible interest rate cut may encourage more of these smaller-scale investments.

Cheaper financing could support upgrades, while appetite for larger, riskier projects remains muted.

Swakopmund showed a stronger rebound in activity, with completed projects rising to 47 in August, valued at N$36.9 million, up from 27 in July but still below the 61 recorded in August 2024.

Residential developments dominated, with 45 projects completed, including 29 new houses and 16 extensions or alterations.

Two commercial projects were also finalised. This distribution points to strong housing demand in the coastal town, driven by population growth and urban expansion.

“Overall, Windhoek’s construction landscape reflects economic caution and incremental development, while Swakopmund continues to demonstrate resilience in residential growth. Both trends suggest that the housing market is adapting to current conditions, with smaller projects likely to remain the driver of activity until broader economic signals and credit conditions improve,” Pulse said.

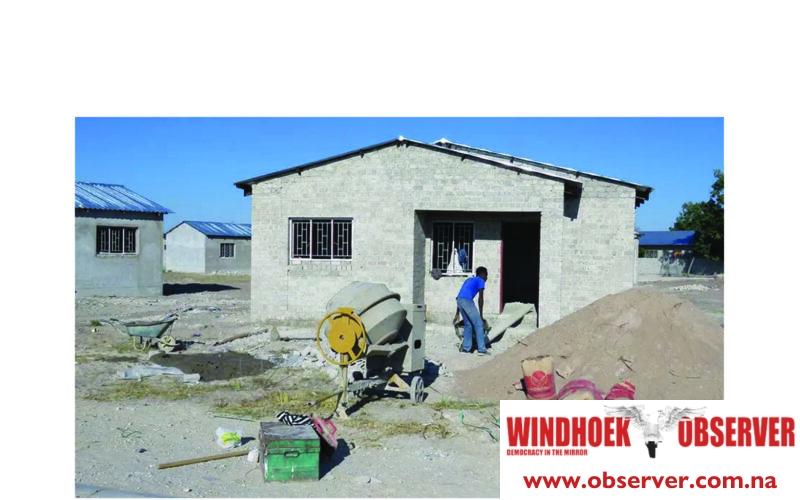

Caption

Construction activities remained modest in August.

- Photo Contributed