Chamwe Kaira

Projections made by Finance Minister Ericah Shafudah rest on assumptions that require careful interpretation.

Economic analyst Almandro Jansen said maintaining GDP growth above 3% depends on how quickly investments in energy, logistics, and housing move forward, as well as on continued private-sector confidence.

He noted that SACU inflows, which still make up about a third of total revenue, remain exposed to regional trade performance and South Africa’s fiscal outlook.

Jansen said election-year spending in the 2026/27 financial year could test the government’s commitment to spending cuts. He said Simonis Storm’s assessment is that the fiscal outlook is credible but conservative.

“We anticipate a mildly expansionary fiscal stance through 2026, balancing electoral and economic imperatives, followed by a firmer consolidation path thereafter. This sequencing is rational: expansionary spending in the near term supports confidence and growth, while the gradual return to consolidation post-2026 ensures medium-term sustainability,” said Jansen.

Namibia’s funding mix remains 80% domestic and 20% external, a structure that protects the country from foreign-exchange volatility and external-debt risks. The borrowing requirement for 2025/26 has surged to N$29.8 billion, more than double the previous fiscal year’s level.

“Such an expansion inevitably tightens domestic liquidity as government debt absorbs a larger share of national savings. Local pension funds and insurance companies, traditionally the main buyers of Treasury paper, are approaching their internal exposure limits to sovereign assets. Once those thresholds are met, Treasury must either raise yields to attract additional demand or diversify its investor base,” Jansen said.

Despite tight fiscal conditions, Jansen said the government achieved several key milestones midway through the 2025/26 fiscal year, showing that its fiscal consolidation efforts are taking shape. One major success was the redemption of the US$750 million Eurobond, which matured in October 2025.

The repayment was fully financed through domestic resources and the Sinking Fund, without new external borrowing.

Public debt has since stabilised at N$176.3 billion, or 67.5% of GDP, and is expected to stay below the 70% threshold in the medium term.

Jansen said the budget deficit widened to 6% of GDP from an initial forecast of 4.6%, mainly due to weaker revenue and the Eurobond redemption. The previous year’s deficit stood at 4.8%, showing temporary pressures rather than structural problems. Public debt rose from N$167 billion to N$176.3 billion, or 67.5% of GDP, nearing the 70% comfort threshold.

Real GDP growth was revised down from 4.5% to 3.3%, compared to 5.4% in 2022 when mining and construction rebounded from pandemic lows. Inflation is expected to average 3.8% this year, while the repo rate remains at 6.50%, indicating a moderately supportive monetary stance.

By September, total revenue collection stood at N$36.6 billion, 40% of the annual target, compared to 43% during the same period in 2024.

“This shortfall exposes persistent structural fragilities in the revenue system. Namibia’s dependence on SACU transfers, which typically contribute 30 to 35% of total revenue, leaves it vulnerable to regional trade slowdowns. VAT and income-tax receipts have also underperformed due to weaker import volumes and a sluggish corporate environment, while VAT refunds, especially to exporters and oil exploration companies, have risen,” said Jansen.

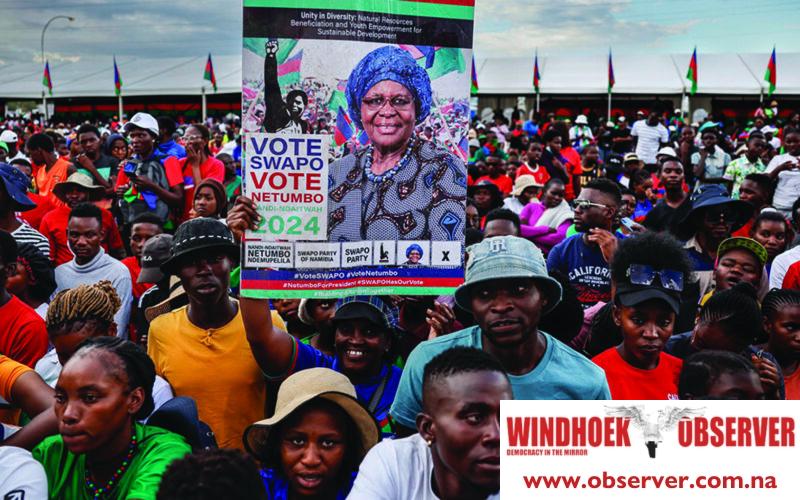

Caption

Election-cycle spending pressures could also test the government’s consolidation resolve.

-Photo: Contributed