Chamwe Kaira

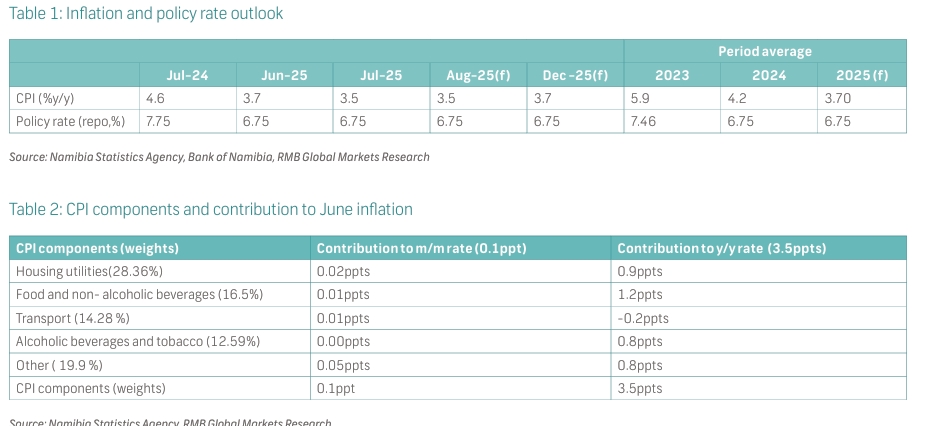

Inflation eased to 3.5% year on year in July, down from 4.6% in July 2024 and slightly below the 3.7% recorded in June 2025. This is the second time this year inflation has reached 3.5%, continuing the disinflationary trend that began in October 2023. The slowdown was driven by last year’s high base and reduced cost pressures across key expenditure categories.

FNB Namibia said it has revised its inflation forecast downward. The bank now expects inflation to ease to 3.5% in August and remain below 4% for the rest of the year, ending at 3.7% in December, compared to the previous forecast of 4.5%. The revision reflects prolonged transport deflation from supply-side factors, weak domestic consumption, and favourable currency movements due to a weaker dollar.

“However, inflationary pressures persist in food, housing and utilities, and alcohol, with these three categories contributing +2.93 ppts to headline inflation. Meanwhile, the dampening impact from transport (-0.18 ppts) is expected to fade as base effects reverse. Once transport inflation turns positive (likely in 2026 rather than late 2025), headline inflation could reaccelerate even if other categories remain stable,” the bank said.

Simonis Storm expects August inflation to remain between 3.5% and 3.8% year on year. “Downward pressure from transport is likely to continue but weaken, while housing inflation may edge higher as more distributors adjust retail tariffs. Food inflation should remain elevated, driven by meat and vegetable prices, though the pace may stabilise,” the firm said.

Simonis also expects possible increases in global oil prices and regional currency volatility, along with the acceleration of electricity pass-through effects in the late third quarter and climate impacts on agricultural supply chains. “Spillover from global trade tensions, particularly the Trump tariffs, which could raise the cost of imports and stoke second-round inflation in Namibia,” the firm said.

The firm added that while July’s figures offer some relief, risks to inflation remain on the upside. “External shocks from energy markets, food supply disruptions, or trade policy shifts could push inflation above the 4% mark before the year-end.”