Chamwe Kaira

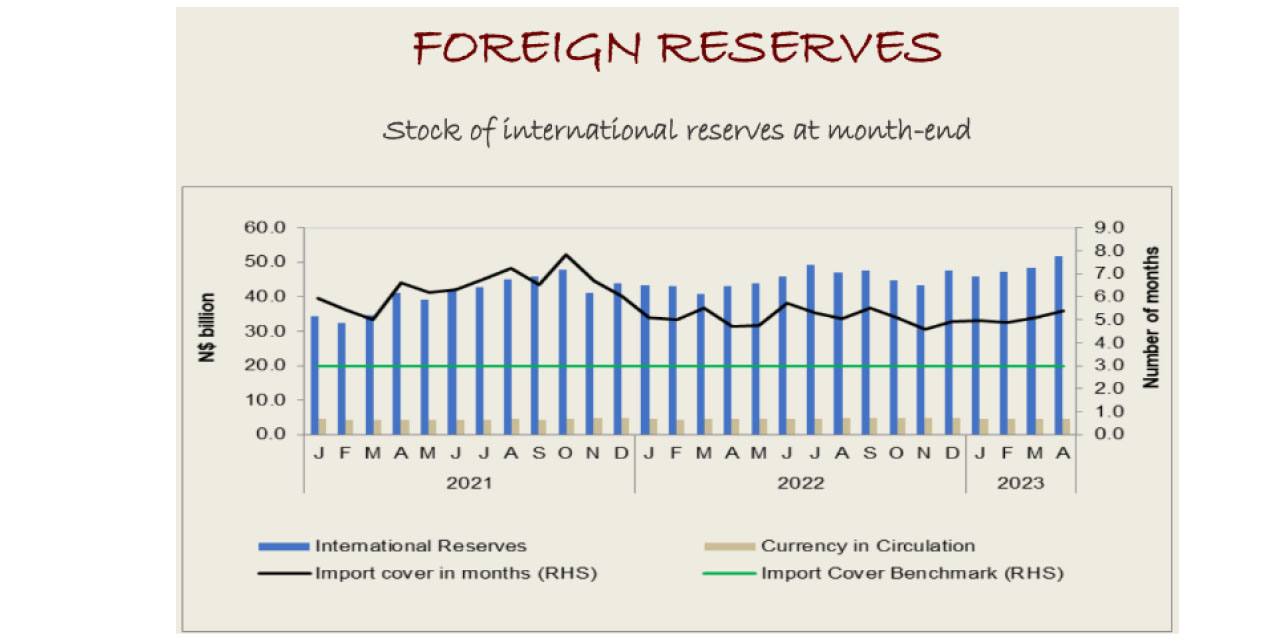

The Bank of Namibia’s stock of international reserves increased in April to N$51.8 billion relative to the N$48.3 billion at the end of March, the central bank said. This is the highest figure the stocks have reached this year.

The increase was on account of higher Southern African Customs Union receipts, diamond sales proceeds and FDI inflows in the manufacturing sector from the sale of Namibia Breweries Limited to Heineken as well as revaluation gains.

“The foreign reserves translated into 5.4 months of import cover higher than the 5.1 months of import cover a month ago, remaining above the international benchmark. This level remains adequate to support the currency peg between the Namibia Dollar and the South African Rand,” the central bank said.

In comparison, the Bank of Namibia’s stock of international reserves increased in March to N$48.3 relative to the N$47.4 billion at the end of February.

For the March figures, the central bank had said the increase is attributed to Customer Foreign Currency (CFC) placements. The foreign reserves had translated into 5.1 months of import cover higher than the 4.9 months of import cover a month ago, remaining above the international benchmark.

The increase to the reserves in February was due to revaluation adjustments and commercial bank inflows during the review period.

In January the stock of international reserves decreased by 3.8 percent, month-on- month, to N$45.7 billion at the end of January 2023. The decrease was due to net commercial bank outflows during the review period.

When compared to the last month of 2022, the stock of international reserves increased by 9.7 percent, month- on-month, to N$47.9 billion at the end of December 2022. The increase was due to the AFDB loan inflow, diamond sale proceeds and increased net commercial bank inflows during the review period.

In other financial indicators for April, the central bank said growth in money supply (M2) accelerated in April. As at the end of April, M2 growth rose to 9.6 percent relative to a growth rate of 1.8 percent in March.

Private sector credit extension slowed at the end of April to 2.6 percent from 3.9 percent in March.

The overall liquidity position of the banking industry increased to an average of N$11.0 billion in April, relative to the N$8.1 billion recorded in March.

Annual inflation slowed to 6.1 percent in April, compared to 7.2 percent recorded in the preceding month.