The Namibian Ports Authority says the mineral commodities are a key driver of Namibian ports cargo volumes.

There is a high correlation between global commodity prices and cargo movement through the port, the Authority stated.

It stated that where the commodity prices are favourable, it drives increased mining activities and an uptick in volumes throughput through the ports supporting these activities.

Commenting on the minerals that are exported via Walvis Bay, the Authority, said in 2022, the copper price increased by 17.8% to an average of US$9,985 per metric tonnes during the first quarter of 2022.

The increase was due to the supply disruption in Chile, which produces about 30% of global copper output, and global supply chain disruptions related to the Russia-Ukraine conflict.

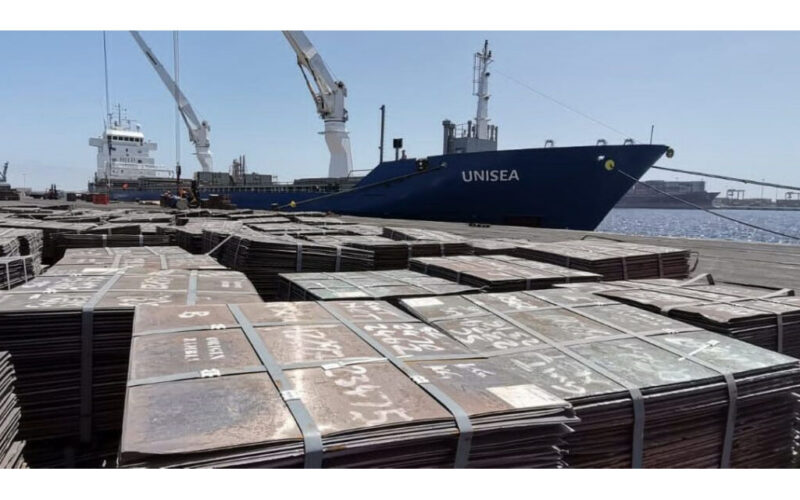

Namport said in the 2022 annual report that copper exports and raw material imports through the Port of Walvis Bay constitute a significant proportion of the volumes throughput through the port, especially on the back of the favourable prices and the ramp of production by Zambian and DRC mines.

The shortage of vessels and twenty-foot shipping containers, the preferred method for packaging copper exports, has however resulted in some losses of this crucial business to other ports, Namport said.

It said long with natural gas and oil, coal prices have surged since Russia invaded Ukraine. In response to the war, the European Union imposed a ban on imports of Russian coal from August 2022, which increased the coal price dramatically.

European countries are looking further afield for coal, including from South Africa, Botswana and Mozambique.

The desire to reduce Russian gas consumption has also slowed the pace at which European countries are decommissioning coal power stations.

Namport said it has benefited from the spike in coal prices as Botswana exporters are now moving their coal exports through the Port of Walvis Bay. The preference for the port has been accentuated by the current congestion at other ports in the region, through which the exports were previously channelled.

The coal is hauled by trucks for stockpiling and shipping, with the first consignment in March 2022. The absence of a rail connection has however hindered the full realisation of the volumes that could be shipped out of Botswana through the Port of Walvis Bay, the report said.

The high uranium price augers well for the Walvis Bay, as most raw material requirements for the mines are shipped through the port, Namport said. This has been evident in the high volumes of imports of chemicals by the active Uranium mines in the Erongo region.

As the manganese price improved, the Port of Lüderitz saw a significant increase in manganese ore exports from South African mines. During the last two financial years, the Port of Lüderitz has handled 640,288 tonnes and 768,085 tonnes respectively, ramping up from initial exports in the 2020 financial year.