Chamwe Kaira

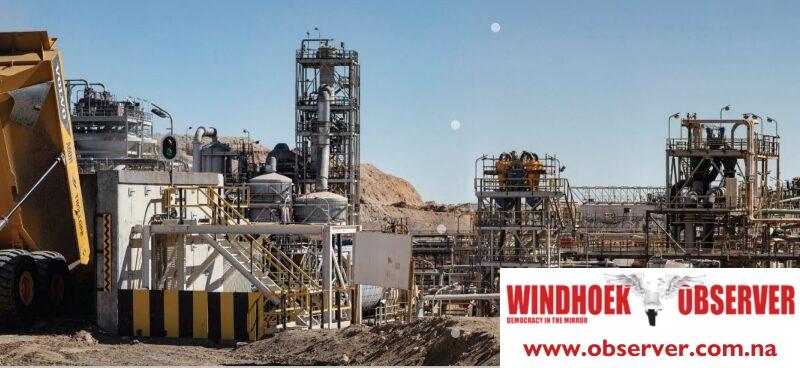

The Langer Heinrich Mine (LHM) processed more than 900 000 tonnes of ore during the March 2025 quarter. This marked the highest throughput since the mine restarted operations. The plant achieved an average recovery rate of 88%, which is within the company’s target.

Paladin Energy, the mine’s operator, said it produced 745,484 pounds of uranium oxide in the March quarter. This was a 17% increase from the previous quarter and the highest quarterly output since the restart. Total uranium oxide production for the nine months ending 31 March stood at two million pounds.

During the March quarter, the company sold 872,435 pounds of uranium oxide, and it sold a total of two million pounds over the nine-month period. Paladin earned an average price of US$69.9 per pound. The cost of production was US$40.6 per pound during the March quarter.

Paladin recorded revenue of US$61 million from the sale of uranium oxide for the quarter. The cost of sales was US$63.6 million. As of March 31, 2025, the company held US$117.3 million in cash and cash equivalents, excluding restricted cash worth US$4.4 million. It also had US$10.5 million in short-term investments.

Initial mining activities at LHM began during the quarter. The company mobilised equipment, completed its first blast, and fed mined ore to the processing plant after the end of the quarter.

Paladin reversed a previously recognised impairment in 2016. This related to a 6.3 million tonne ore stockpile valued at US$92.1 million. The reversal was due to improved uranium prices, progress at the LHM restart project, and key contract negotiations.

“As of March 31, 2025, the group had conducted a review of its inventory items. The assessment considered several factors, including the production to date, the carrying value of the current inventory, the grade performance of the ore stockpile compared to expected performance, the accessibility of part of the stockpile, and the delivery into sales contracts along with the expected contract prices for uranium oxide,” the company said.

Following the review, Paladin recorded a US$19.9 million impairment charge. This was due to a decline in the net realisable value of the ore stockpile and finished goods.

“Management will continue to monitor price movements, production forecasts, and inventory turnover, and it will reassess inventory valuations as required in subsequent periods,” the company said.