Chamwe Kaira

Letshego Holdings Namibia will pay a dividend of N$219.4 million, or 43.88 cents per share, to its ordinary shareholders, according to the company’s interim financial results for the period ending 30 June 2025.

The company, listed on the Namibia Stock Exchange (NSX), declared the interim dividend on 1 August, pending regulatory approval. Salient dates will be announced once approval is obtained.

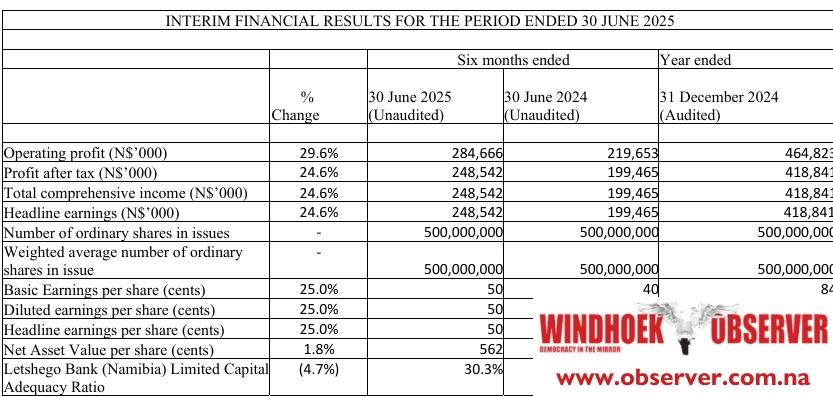

The results showed a 24.6% increase in profit after tax, rising to N$248 million from N$199 million in the six months ending 30 June 2024. Operating profit grew to N$284 million from N$219 million during the same period last year. Basic earnings per share also increased to 50 cents.

However, the company’s capital adequacy ratio dropped by 4.7% to 30.3%. The capital adequacy ratio, or the capital-to-risk-weighted-assets ratio, measures a bank’s ability to absorb losses and comply with statutory capital requirements, as tracked by the Bank of Namibia (BoN).

The International Monetary Fund (IMF) noted that Namibia’s banking system remains profitable, liquid, and well-capitalised, with some easing in asset quality risks. The IMF also reported improvements in Return on Assets (ROA) and Return on Equity (ROE), while the Liquid Assets to Total Assets Ratio (LAR) rose and the Capital Adequacy Ratio (CAR) remained adequate.

Letshego said it entered the second half of 2025 with a renewed focus on its leadership, agility, sustainability, execution, and resilience (L.A.S.E.R.) strategy. The company remains committed to delivering sustainable returns from recent investments in people and systems while positioning itself as a future-fit financial services provider.

Key priorities include expanding digital access through the Mobile Banking App (LetsGo Digital Mall) and USSD platforms, enhancing customer experience, and using analytics to offer personalised financial solutions. The company will continue to build strategic partnerships to drive innovation and expansion. Information and cybersecurity remain a top priority to ensure continued trust with clients. With a strong capital base, robust governance, and a customer-centric approach, Letshego Holdings Namibia is well-positioned to navigate changing market conditions and deliver long-term value to shareholders and communities.