Staff Writer

Namibia is among the most improved countries in attracting foreign direct investment (FDI).

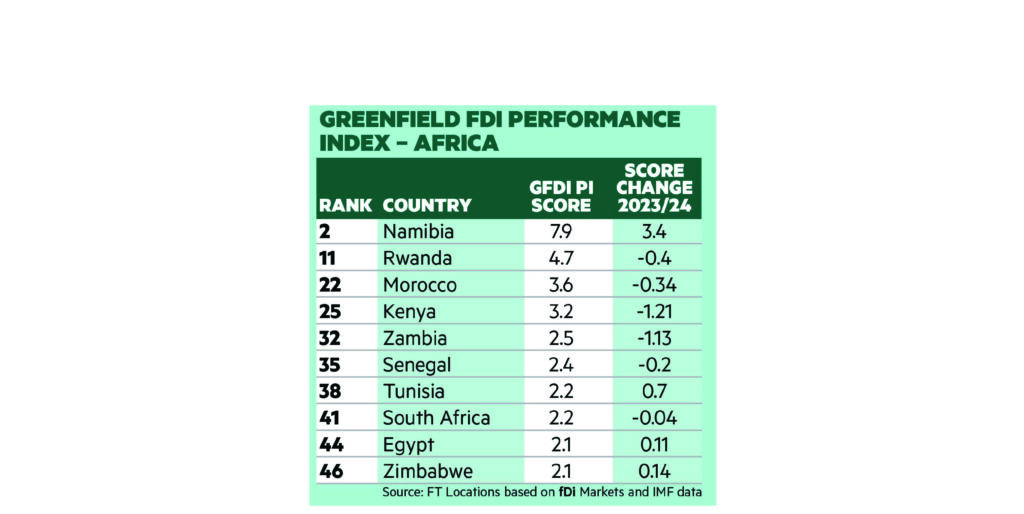

This comes as the country ranked first in Africa and second globally in the 2025 Greenfield FDI Performance Index.

Namibia climbed 10 places from the previous year, outperforming its expected share of FDI projects by almost eight times, the index stated.

The index measures how effectively countries attract greenfield FDI projects relative to the size of their economies.

El Salvador, Iceland, Moldova, Kyrgyzstan, Laos and Namibia are among the countries that showed the biggest improvement.

While smaller economies see amplified changes in rankings from shifts in annual project counts, the index notes that these countries are also improving their offerings to foreign companies.

According to the report, Namibia’s rise is driven in part by recent offshore oil discoveries in the Orange Basin, where Total and Shell drilled multiple exploratory wells.

The country holds an estimated 11 billion barrels of light oil and 2.2 trillion cubic feet of natural gas reserves.

This would put Namibia’s reserves on par with Guyana.

“If proven commercially viable, the finds could unlock an unprecedented revenue windfall for the Namibian government, more than doubling the country’s GDP by 2040,” the ITA report stated.

Oil service companies, including Baker Hughes and Halliburton, have expanded their presence to support the growing sector.

Beyond oil and gas, Namibia has also attracted investment in sustainable energy and manufacturing.

The index states Coca-Cola Beverages Africa has committed $50 million (roughly N$900 million) to install a new bottling line and develop a water treatment plant.

“Stability, rule of law, including an independent judiciary, and openness to investment have all been conducive to attracting foreign investment to the country,” said Nangula Uaandja, the chief executive officer of the Namibia Investment Promotion and Development Board (NIPDB).

Namibia was ranked fourth in Africa for investment attractiveness to mining companies in 2023 by the Fraser Institute, behind Morocco, Botswana and Zambia.

While FDI is rising, authorities are focused on ensuring investment benefits the wider economy.

The country remains one of the most unequal in the world, with one in three in the labour force unemployed and youth unemployment at 44.1%.

Uaandja said the NIPDB was created to link investment promotion with small business development to boost employment. “We have two main roles,” she said.

“First, we have to make sure the labour force meets the needs of the economy, which also means making sure those needs are known and communicated to the universities. Secondly, we have to bring small businesses into the value chain. As regards this latter issue, we have already created a database of Namibian small and medium-sized enterprises so that every investor that comes in can connect with local supplies.”

The International Monetary Fund expects that headline net foreign direct investment (FDI) will remain above $2 billion per year until 2030.

Its June Article IV report noted that “while Namibia’s economy continues to expand, mainly thanks to foreign investment in its mineral wealth, job-rich, private sector-led growth has remained elusive.”

Caption