Chamwe Kaira

Oryx Properties has included in its funding strategy the upcoming maturity of its N$248.5 million corporate bond due in November.

The company said discussions with potential investors and arrangers are already underway.

“The directors are confident in the group’s ability to refinance or repay the bond through available liquidity or new issuances,” Oryx said.

For the year ended 30 June 2025, Oryx reported a net asset value of N$2.58 billion, down from N$2.77 billion in 2024.

Available funding stood at N$385 million, excluding a Domestic Medium-Term Note Programme of N$251.5 million and ring-fenced facilities of N$154 million for the Maerua Mall development and N$178 million for the Goreangab development.

The directors reviewed the group’s ability to continue as a going concern and concluded it has sufficient resources to meet obligations over the next 12 months.

Debt facilities amounted to N$2.76 billion, with N$448.5 million scheduled to mature during the period. Oryx said it remains confident of refinancing these facilities on favourable terms.

Liquidity forecasts indicate that cash resources and facilities are adequate to cover operational and financing needs.

All debt covenants were met as of 30 June 2025, and forward projections indicate continued compliance.

The company expanded its Domestic Medium-Term Note Programme from N$500 million to N$1 billion in preparation for the bond maturity.

During the reporting year, Oryx acquired Safari Investments Namibia (Pty) Ltd, the owner of Platz am Meer shopping centre in Swakopmund.

The acquisition, funded through external financing, added to the group’s asset base and strengthened long-term rental income. No disposals were made in the year.

The carrying value of investment properties was N$4.6 billion for the group and N$733 million for the company. Changes in the fair value of investment properties resulted in a gain of N$98.6 million for the group and a loss of N$25.3 million for the company.

On taxation, Oryx reported a deferred tax expense of N$278.4 million and a current tax expense of N$5.8 million, compared to N$18.9 million and N$1.6 million, respectively, in 2024.

Oryx said amendments to the Income Tax Act, including the five-year limit on assessed losses and restrictions on interest deductions, had a material impact on its tax position.

Oryx said it is engaging with industry bodies and tax authorities to address the implications of the new tax regime on the property sector.

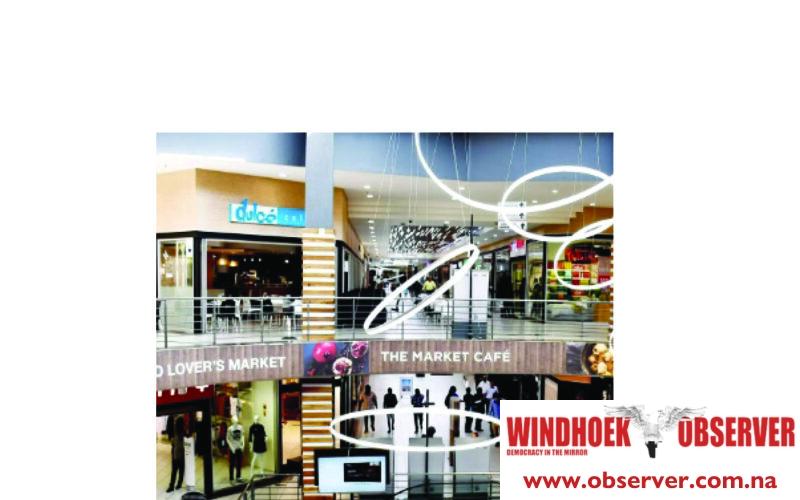

Caption

Maerua Mall in Windhoek is owned by Oryx Properties