Chamwe Kaira

Paladin Energy, whose only producing mine is the Langer Heinrich Mine, has secured 13 uranium sales agreements with international customers. The contracts cover 24.1 million pounds of uranium oxide through 2030.

The agreements, disclosed as of 30 June 2025, include fixed-price, market-related and base-escalated pricing mechanisms, mostly denominated in US dollars. Pricing references published spot and term uranium prices and may include floor and ceiling limits.

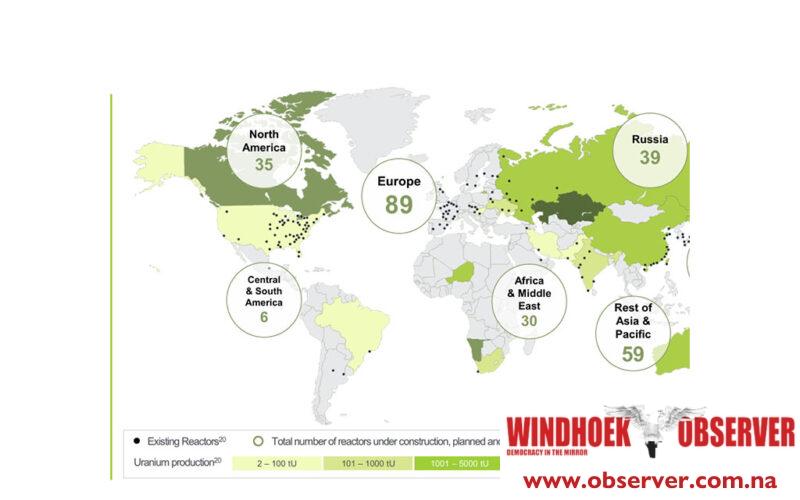

Paladin said global demand is supported by existing reactors, new construction and life extensions in the United States and other countries.

“Commitments made at COP28 and COP29 to triple nuclear capacity by 2050, along with US policy moves under President Donald Trump to expand the American nuclear fleet fourfold, point to significant incremental uranium demand in the coming decades. The rapid growth of artificial intelligence and data centres is also expected to drive demand for clean and reliable baseload power,” the company stated.

The largest consumers of uranium, including the United States, China and France, have limited domestic supplies. European utilities source about half of their uranium from Kazakhstan, Russia and Niger but are shifting to diversify.

Paladin noted that Chinese utilities have been more aggressive than Western buyers in securing long-term supply. Global utilities face uncovered uranium requirements of about one billion pounds through 2035.

Paladin’s production depends entirely on the Langer Heinrich Mine in southern Namibia. The company said it must replace ore reserves depleted by production to sustain or increase output.

“This will require further exploration, new discoveries, or acquisitions. Paladin cautioned that failure to replenish reserves could limit future production levels.”

The company also highlighted risks beyond its control, including macroeconomic conditions, geopolitical events, public opinion on nuclear energy and competition from other energy sources.

It warned that changes in taxes, tariffs or regulations in producing countries such as Kazakhstan, Canada, Namibia and Australia could affect the market.

Langer Heinrich recorded revenue of U$177.7 million in the financial year ended 30 June, from sales of 2.7 million pounds of uranium oxide. The cost of sales of U$191.7 million reflected the ramp-up of operations.