Chamwe Kaira

The Bank of Namibia’s international reserves increased by 3.8% to N$59.6 billion at the end of June.

This rise was mainly driven by net inflows from commercial banks and customer foreign currency (CFC) placements. The reserves cover 3.9 months of imports, or 4.8 months excluding oil exploration and appraisal activities.

Namibia’s banking industry cash balances fell further in June. Commercial banks held N$6.1 billion in cash, down from N$8.5 billion in May, primarily due to corporate tax payments made at the end of the month.

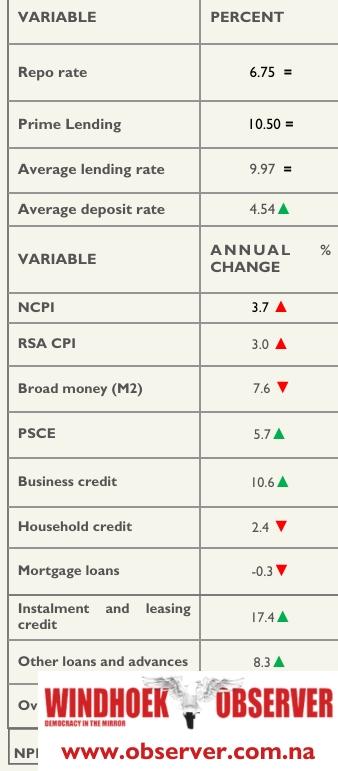

Growth in broad money supply slowed in June. Annual growth in M2 decreased to 7.6%, down from 8.1% in May.

This slowdown was driven by a drop in domestic claims, particularly net claims on the central government. However, annual growth in net foreign assets increased, offset by the reduced growth in domestic claims.

Private sector credit extension (PSCE) grew annually by 5.7% in June, reaching N$120.1 billion, the highest growth since March 2020.

This growth reflected increased business demand for loans, especially in other loans and advances, overdrafts, and instalment sales and leasing.

Overdraft lending saw an annual growth of 17.4% in June, up from 6% in May. This increase came from higher uptake by corporates in the real estate sector for property acquisitions and in the manufacturing sector to support consumer demand.

Instalment sale and leasing credit also grew, rising to 17.4% in June from 13.8% in May. Both businesses and households contributed to this growth, which was reflected in the higher number of vehicles sold during June.

Mortgage credit remained negative for the third consecutive month, with an annual decline of -0.3% in June, compared to -0.2% in May.

The contraction was due to higher repayments by corporates, write-offs, and weak demand for mortgages from households.