Chamwe Kaira

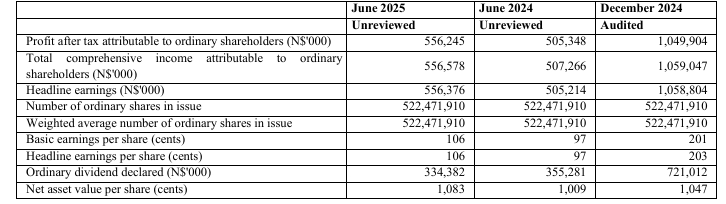

Standard Bank Namibia Holdings reported a 2.9% increase in interest income to N$1.1 billion for the six months ended 30 June.

The growth was supported by an 8.8% rise in gross loans and advances to customers and an 18.4% increase in other interest-earning assets.

Lending activity started slower than expected, which limited the impact on average balances, a key driver of net interest income.

A cumulative 100 basis point cut in the repo rate also reduced margins.

Non-interest revenue rose by 3.6% to N$792.7 million, driven by higher client activity and greater use of digital services.

Net fee and commission income increased by 7.4% due to more transactions and improved use of digital channels. Trading revenue fell by 13.8% as a stable currency market, lower short-term yields, and the absence of one-off gains from the previous period put pressure on margins.

Credit impairments dropped by 21.8% due to stronger credit risk management. Accounts moving into non-performing loans fell by 46%, and fewer accounts showed significant credit risk.

The non-performing loans ratio improved to 3.7% from 4.7% at the end of December 2024. NPL exposures declined from N$1.5 billion to N$1.4 billion, while the NPL coverage ratio increased to 35.6% from 34.7%.

“The group continues to maintain a prudent provisioning stance and actively reviews its strategic pre-NPL and NPL initiatives to ensure that they remain responsive and fit for purpose in the ever-evolving risk landscape,” the group said.

Operating expenses rose by 2.1% to N$1 billion, remaining below average inflation of 3.5%.

Staff costs increased by 11.3% due to annual salary adjustments, a higher headcount, and performance-based pay. IT expenses fell by 6.8% due to cost-saving measures and delayed spending.

Customer deposits and current accounts grew by 3.6% to N$29.7 billion. Current accounts increased by 7%, term deposits by 16.3%, and NCDs by 21.2%. Financial assets rose by N$1.4 billion, largely from higher investments in government bonds and treasury bills.

The group’s total capital adequacy ratio stood at 17.25% and its common equity tier 1 ratio at 15.31%, both well above regulatory requirements.