Tujoromajo Kasuto

Trevali Mining has received credit approval from Standard Bank Namibia and Standard Bank of South Africa for a N$1.86 billion (US$110 million) to fund the expansion of the Company’s Rosh Pinah Mine in Namibia.

“Project financing for the Rosh Pinah expansion has been steadily progressing for the past several months, and we are pleased to report the confidence in the Rosh Pinah operation and expansion that is reflected by Standard Bank’s credit approval and strong endorsement of the RP2.0 project,” says Ricus Grimbeek, President and Chief Executive Officer (CEO) of Trevali.

“The expansion at Rosh Pinah is the primary focus for Trevali in the coming years, and we look forward to working with Standard Bank as a supportive lender that has intimate knowledge about the Rosh Pinah Mine, the expansion plan, and long-term operating success that has been achieved since mining began in 1969.”

This follows the release of positive findings from an independent RP2.0 feasibility study last August.

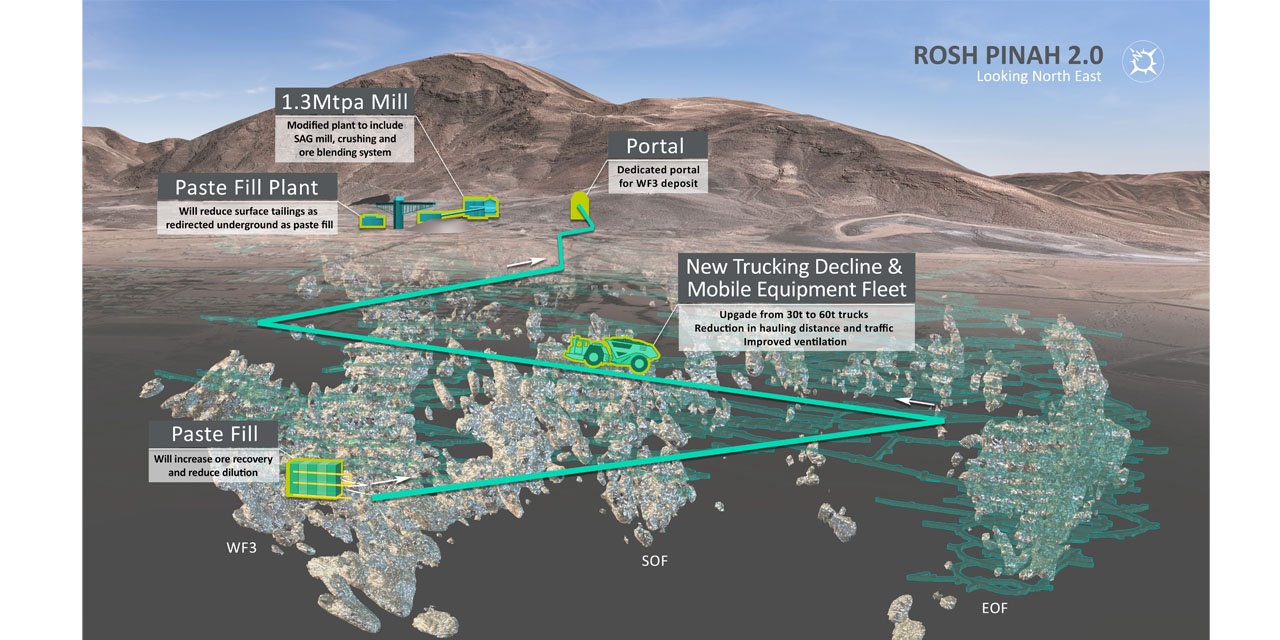

The study considered increasing the current throughput from 700,000 oz/y to 1.3 million tonnes per year by modifying the processing plant, building a paste fill plant, and developing a dedicated portal and ramp to the WF3 deposit.

The early works programme includes the purchase of mobile equipment, an upgrade to the power supply system; the purchase of long lead items for the paste backfill; portal construction and decline development, and detailed engineering for the process plant.

Trevali had previously hired Endeavour Financial to advise on the formation of a lending syndicate, coordinate lender due diligence, and negotiate financing documentation to provide a competitive non-equity financing solution for RP2.0 and refinance the company’s existing corporate revolving credit facility.

Trevali says it was considering several financing options, including project finance debt, subordinated debt, and a silver stream on Rosh Pinah’s silver production. Over a nine-year post-expansion mine life, the expanded mine is expected to produce 135 million pounds of payable zinc, 23.7 million pounds of lead, and 303 000 oz/y of silver on average.

The credit approval comes after the signing of a mandate agreement with Standard Bank in March as well as the completion of legal and technical due diligence on the Rosh Pinah Mine and the RP2.0 project, which included a site visit to the operation.This is part of the initial works programme, which had a capital budget of N$336 million (US$20 million).

The Rosh Pinah underground zinc-lead mine and 2,000 tonnes per day milling operation is located in southwestern Namibia, about 800 km south of Windhoek and 20 km north of the Orange River, at the edge of the Namib Desert.

The Rosh Pinah mine has been in continuous operation since 1969, and currently produces zinc and lead sulphide concentrates containing minor amounts of copper, silver and gold. The zinc and lead concentrates are transported by road to Lüderitz, a port on the Namibian coast, and then shipped to the international spot markets.

The Rosh Pinah mine is 90% owned by Trevali and 10% by Namibian Broad-Based Empowerment Groupings, an Employee Empowerment Participation Scheme (EEPS).