Stefanus Nashama

Bank BIC Namibia clients are reportedly unable to perform electronic banking or withdraw their funds at the Automatic Teller Machines (ATM), instead, they have to negotiate with the bank to access their cash.

Martin Lukas, a client of the bank, explained that bank officials told him that the system was hacked.

“All they told us is that the system was hacked but no official communication was made to us. We have been forced to go inside since the beginning of March,” he said.

Clients raised their concerns due to a lack of communication from the bank.

Some customers believe the bank is struggling financially and that it is unable to meet its obligations to account holders.

Last year in December, Bank BIC recorded a loss of N$62 million for the year ended December 2022, according to media reports.

During the same period, the bank also ran the risk of losing its licence to operate in Namibia because one of its shareholders was deemed unsuitable and could not have direct or indirect participation in the bank’s affairs.

The bank’s chairperson, Hugo Teles at the time said the bank was under immense pressure as a result.

“We had to remove the shareholder from our structure, but that does not depend on us, it depends on the shareholders,” he said.

The Bank BIC Group is a financial services subsidiary of a conglomerate based in Angola, and it is said to be linked to Isabel dos Santos, a prominent Angolan businesswoman who is the oldest child of former Angolan President José Eduardo dos Santos.

Isabela held shares in the bank through Sociedade de Participações Financeiras (25%) and Finisantoro Holdings Limited (17.5%).

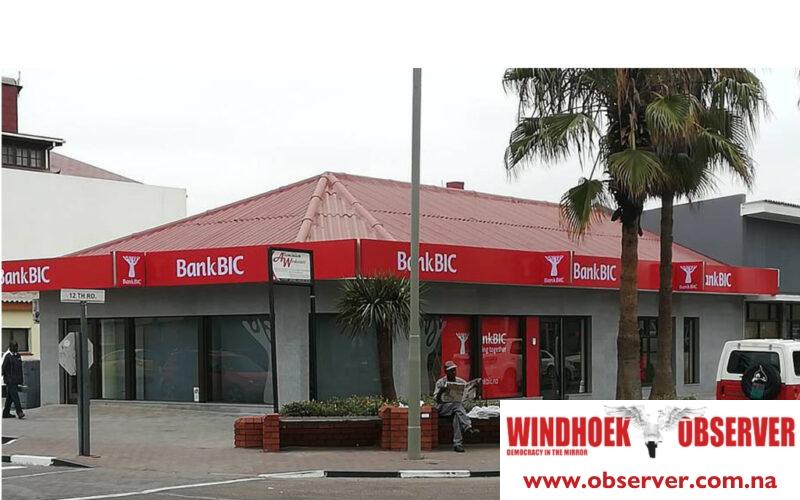

Bank BIC is a commercial bank in Namibia licensed by the Bank of Namibia where it operates five branches, two of which are located in Windhoek, and one each in Walvis Bay, Rundu and Ongwediva.

Contacted for comment this week, Bank BIC Namibia’s Chief Executive Officer, Lindsay Crawford, declined to comment on the matter.

He referred this publication to the bank’s public relations officer, who has remained unreachable for comment.